I posted another recording. This one’s a gem. It is by Mal McSwain, a dear friend of mine, one of the first “club kids” in all of Young Life, and now one of its heroes. Mal talks about how to prepare a club talk. He also talks about what is our message? This includes the first 2 club talks of the semester by Bob Mitchell with commentary by Mal. Enjoy!

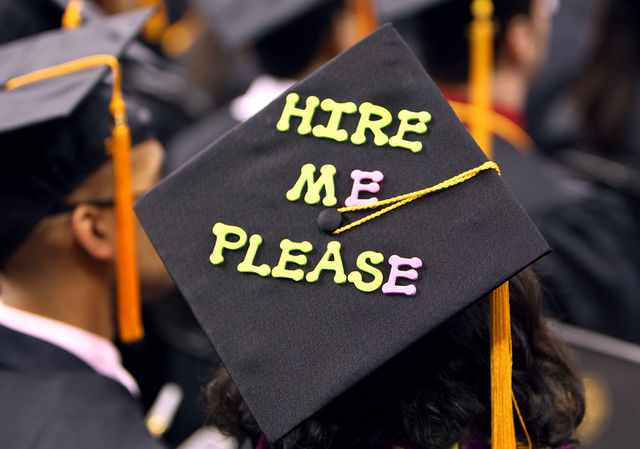

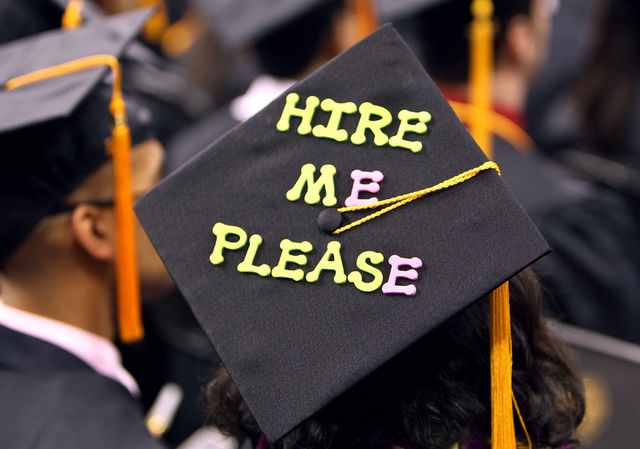

I just got home from a gathering of about 30 seniors from JMU to talk about “Is there life after college?” We talked about their transition to “real life” and what might be some things that would help them make the jump. Topics like: money, time management, professionalism, self-care, life tips, etc. will be part of it. I thought I would include my top 7 of all the stuff we talked about. We will meet next week as well and I will share 7 more. Here goes.

1. Don’t prioritize your schedule, schedule your priorities.

Find out what matters to you, and make sure that it reflects in your schedule. Put the big rocks in first, and then guard them.

2. Life right out of college is weird.

You have so many changes at once that it can make you feel lost, confused, alone or in a “fog.” That’s OK, it’s normal. And this season doesn’t last forever. Challenging stretches do NOT mean that you have made a mistake.

3. Figure out what is life-giving to you, and make sure you make space for it.

Learn to read the gauges of your life: Physical, emotional, spiritual, social, etc.

4. If you want to develop yourself, the 2 things that will impact that the most are the people you’re around, and the resources you take in (books, blogs, articles, experiences, etc.)

5. You’re attitude towards money is a choice. It is either scarcity or abundance. I would go with abundance. We reap what we sow. If we sow generosity, we will reap abundance. Learn to steward your money. It’s the only place in the Scriptures that God asks His people to test Him. Malachi 3:9-10. Try it out.

6. Money can’t buy you love, but learning to steward it well will save you lots of pain.

7. Compound interest is INCREDIBLE. Start investing monthly NOW. Even if it’s a small amount.

Recommended Investment order (and set them up for automatic deduction)

- Matching 401K (or any match from employer)

- Roth IRA

- An “emergency fund” of about 3 months of expenses

- Start a car fund. Even if it’s a small amount. Save it every month.

Bonus tip: NEVER carry a balance over on a credit card. If you have credit card debt, focus all your effort on the one with the highest interest rate. And attack it.

What advice or counsel would you suggest to a graduating senior? Please share in the comment section.